From 1 September 2017, all Australian businesses will be banned from charging customers excessive surcharges for using certain types of EFTPOS, Mastercard, Visa & American Express cards to make payments.

The ACCC ban restricts the amount a business can charge customers for using an EFTPOS (debit & prepaid), MasterCard (credit, debit & prepaid), Visa (credit, debit & prepaid) and American Express cards issued by Australian banks.

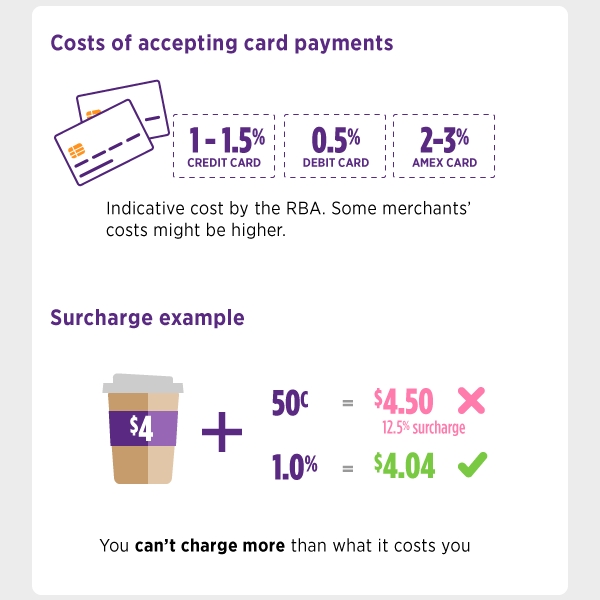

“The good news for consumers is that businesses can now only surcharge what it actually costs them to process card payments, including bank fees and terminal costs. For example, if a business’s cost of acceptance for Visa Credit is 1.5 per cent, consumers can only be charged a surcharge of 1.5 per cent on payments made using a Visa credit card,” ACCC Deputy Chair Dr Michael Schaper said.

The ban does not apply to a businesses Minimum Spend policy. We may see Minimum Spends rise as a result of the ban.

Source: Excessive Payment Surcharge Ban